Back

ChoiceMarch 12, 2023. 17:51

10 min

Which business type to choose – UAB or MB?

Content

1. Introduction

A common question our accountants get from newly setting up companies' managers - "Advise which business type to choose - UAB or MB?"

Of course, it is up to the future manager to decide, but we have produced a short summary so that you can quickly and efficiently compare key structural and tax differences and facilitate your decision-making.

2. Key structural differences

| A LIMITED LIABILITY COMPANY (UAB) | A SMALL COMMUNITY (MB) | |

| Owners | Individual and legal persons | Individual persons only |

| Number of owners | UAB | MB |

| Governing body | 1-250 | 1-10 |

| Liability | Limited civil liability | |

| Equity | >2500 EUR | NONE * |

| Accountant | Required | Optional, you can do accounting by yourself |

| Accounting | Complex accounting ** | |

3. Tax differences

Income tax

- Income tax benefits are based on annual income and number of employees and do not depend on the type of business.

- MB income tax relief applies only if MB members do not own more than 50 percent shares in other companies.

| Annual revenue | The number of employees | Income tax | ||

| < 300.000 EUR/year | > 300.000 EUR/year | < 10 | > 10 | |

| 5% | ||||

| 15% | ||||

| 15% | ||||

| 15% | ||||

Salary-related taxes

- Salary-related taxes for employees are the same for both MB and UAB, but MB may choose not to have employees at all. UAB must have at least one employee - a director.

- MB pays PSD and VSD fees to SoDra from funds paid for personal needs by members.

- All income of MB members received from MB is considered Class B income, so the obligation to pay Personal Income Tax (GPM) falls on the MB member who received the income.

VAT (PVM)

- Company formation fees for the Registry Center are similar for both types of business.

- If the UAB owns real estate, real estate tax is paid.

- UAB is obliged to pay 15% taxes on dividends paid.

Other taxes

- Salary-related taxes for employees are the same for both MB and UAB, but MB may choose not to have employees at all. UAB must have at least one employee - a director.

- MB pays PSD and VSD fees to SoDra from funds paid for personal needs by members.

- All income of MB members received from MB is considered Class B income, so the obligation to pay Personal Income Tax (GPM) falls on the MB member who received the income.

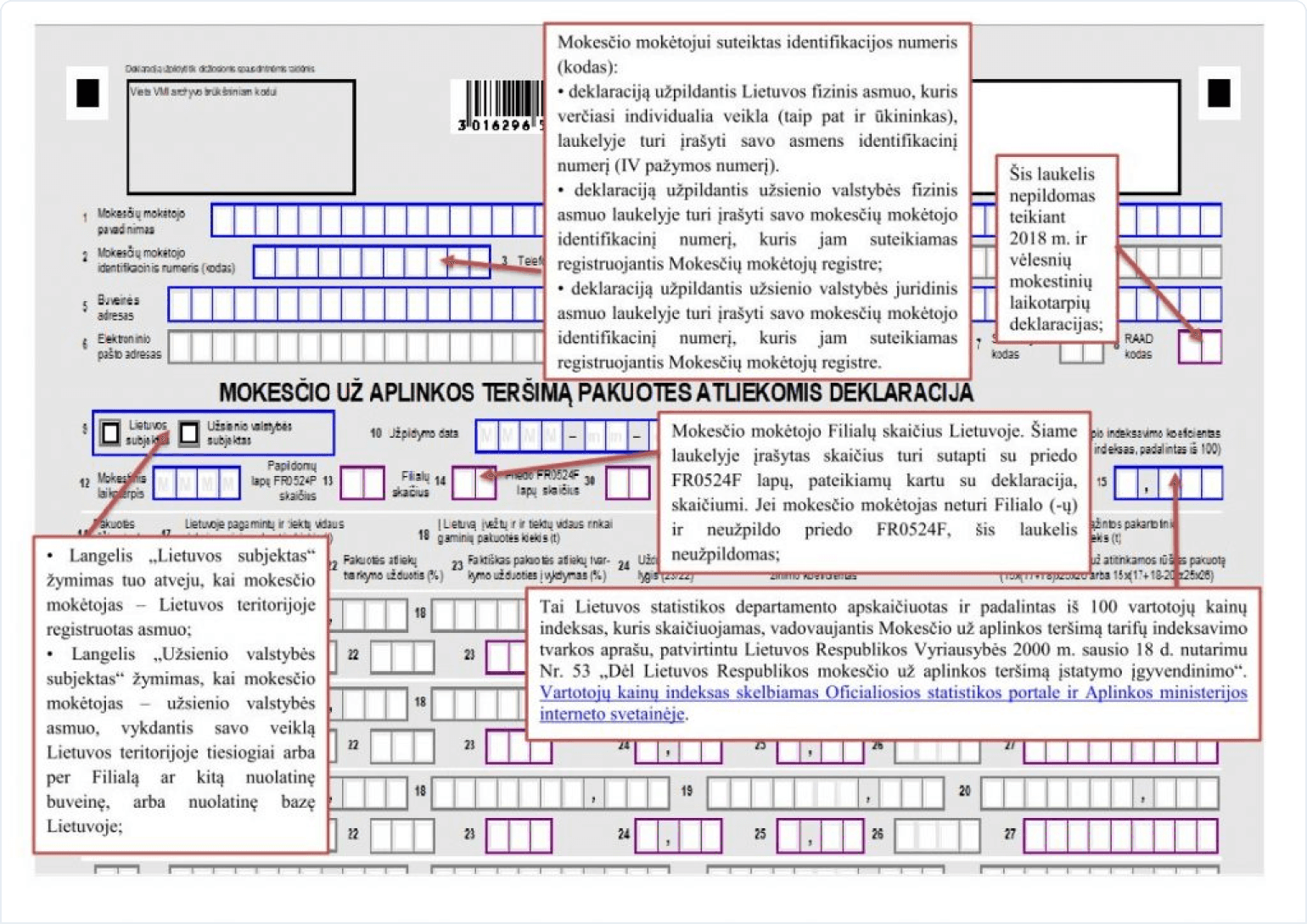

Example: Declaration for class B income

Example: Declaration for class B incomeIt is important to mention that these are not final and fixed taxes. Your company's accountant will advise you on all taxes related to your company's activities. This section only provides guidelines to help you decide which type of business to choose when setting up a new business.

Atgal

Need help setting up a business, want to entrust your company's accounting to a professional RoboLabs team?

Let's have a chat: